By Ryan Hohag, Director – Global Air Practice

As borders around the world are gradually reopening, airlines are starting to resume flights. However, around half of them are canceled at the last minute. Why? Demand is lagging behind. Consumer confidence is still weak. Airlines are looking for travelers and doing their utmost to communicate on biosafety measures, and being transparent is key to restoring confidence. But nobody expects demand to return to pre-crisis levels anytime soon. Airlines will have to do more and reinvent themselves in many ways, and pricing is part of the equation.

It’s time for airlines to reset their strategies. Simplified and transparent airline pricing will help rebuild that missing consumer confidence. Let’s start today with the airline-imposed surcharge, formerly known as the fuel surcharge.

Transparency in the beginning

Airlines first introduced fuel surcharges in 2004, after oil prices surpassed US$40 per barrel. Fuel surcharges were intended to offset a proportion of the airlines’ increased fuel costs over and above a threshold price for a barrel of oil. Airlines justified the new surcharge as a temporary and systematic adjustment to market conditions – presumably a simple solution that would allow airlines to avoid numerous adjustments to the base fare throughout the year. At the time, the system was transparent.

A corrupted model

However, as of 2008, many airlines have increased fuel surcharges more quickly than the rise in the price of oil. Of course, without any regulation requiring these surcharges to be pegged to the cost of fuel, the surcharges stayed in place long after the price of oil plummeted, and continued to increase disproportionately to the price of fuel (even by taking fuel hedging into account).

Eventually, through the intervention of numerous government transport agencies, the fee could no longer be called a “fuel surcharge” as it was clearly not a representation of the per-passenger fuel cost. However, most airlines responded by simply relabeling the surcharge as an airline-imposed surcharge, and the resulting impact was the start of a new era marked by increased obfuscation.

Here’s a basic illustration of this non-transparent and unequal model: In 2004, airlines started to implement a fuel surcharge when the spot price for Brent crude oil was trading just below $38/barrel. The amount of the fuel surcharge was around £35 for a transatlantic sector in the business cabin (ex: London to New York, one-way). Today, the spot price for Brent crude oil is at the same level as 2004 ($ 41/barrel on June 29, 2020). The amount of the ‘airline-imposed surcharge’ is now at £270 on the exact same itinerary (London to New York). Eight times more expensive than it was in 2004!

‘We win, you lose’ model

This has become a real issue at a crucial time for the airline industry. As travel demand is at historic lows, being easy to do business with should be one of the airlines’ top priorities. Airlines must show transparency and establish a partnership approach with their most valuable segment – corporate accounts. For corporate travel clients, there are several problems with this airline-imposed surcharge model:

1. Surcharges are highly inconsistent.

The actual surcharge paid by the traveler on a given route will depend on several variables, including but not limited to operating carrier, cabin, and country of origin.

For example, a one-way business class ticket on British Airways from London Heathrow (LHR) to New York (JFK) currently carries a total surcharge (YQYR) component of £215. Book a similar ticket originating in New York, however, and your surcharge jumps to £523!

Some carriers have decided to remove fuel surcharges on specific travel sectors. Air France has decided to retire surcharges on domestic France and intra-European flights but has maintained a surcharge on long-haul flights. Other carriers like Lufthansa do not apply any surcharge on economy entry-level fares in order to propose attractive all-in fares and be competitive versus low-cost carriers.

2. Surcharges are not subject to discounts.

In some markets, the surcharge on a ticket can cost as much as the base fare. And since the surcharge component is non-negotiable, the reality for corporate buyers can be a substantial overall increase to their air spend.

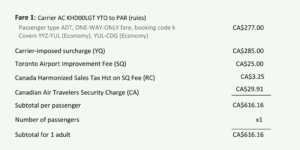

Consider the following one-way economy ticket from Toronto to Paris with Air Canada. Out of the total $616 ticket value, only $277 is represented by the actual airfare while the added fees and surcharges account for more than 50% of the cost.

3. Surcharges are regulated in few markets, non-regulated in many of them

Some countries have decided to regulate the application of fuel surcharges, meaning the government has to approve any changes. These include: Australia, Argentina, Brazil, China (for domestic flights), Hong Kong, Japan, New Zealand, Taiwan, Thailand, The Philippines, Turkey and Vietnam.

As a result, there are much higher levels of transparency and accountability.

For example, in Japan, the surcharge is still labeled as a fuel surcharge. It’s clearly indicated on JAL and ANA websites that the fuel surcharge may be increased, decreased, or abolished depending on the market price of fuel. For tickets issued on/after June 1 until September 30, 2020, the JAL fuel surcharge from Japan to Europe is €32 per sector. Compared with €160 per sector on average by European airlines from Europe (non-regulated markets) to Japan, the surcharge is 5 times cheaper exit Japan!

Restoring credibility: remove the airline-imposed surcharge!

In the wake of COVID-19, it’s time for airlines to be transparent and simplify pricing. There’s a unique opportunity for airlines to realign their long-term strategy and earn their customers’ loyalty by removing unnecessary layers of complexity. With the new air retailing model, we will see customized pricing packages including various service options proposed to corporate clients. There will be a greater focus on what defines the product delivered to the client. In that context, we cannot consider fuel as an option that a client could pay for, like an extra-legroom seat or a business class upgrade. Imagine if your monthly rent contained a surcharge component for the walls in your apartment. It’s the same concept.

The fuel surcharge as it exists today does not reflect the real cost of fuel for airlines. Surcharges can vary dramatically even on the same airline, for the same cabin and itinerary. In non-regulated markets, the lack of transparency has caused the problem to spiral out of control. Since there is no link between the surcharge and the actual cost of the air service, it makes no sense to maintain it as a surcharge, it only contributes to client mistrust and confusion about airline pricing. Since fuel is something that must be used on every flight, it should be part of the base fare. Airlines that take action to adjust their pricing models and get rid of this antiquated surcharge will be in a stronger position to drive traveler confidence in their brand and services when demand for business and leisure travel starts to increase again.