By Greg Toussaint – Director, Edgar, Dunn and Company

As the travel and finance industries continue to evolve at a rapid pace, it’s critical for travel managers to future-proof their travel programs by staying on top of payment best practices and avoiding outdated payment methods.

Having a robust travel payments program in place can not only generate higher financial rebates, but result in a better user experience, better cost optimization, and greater internal efficiency!

Payment best practices every travel program should consider

So, what does a robust travel payments program look like? Together, Edgar, Dunn & Company (EDC), and Advito have identified four best practices every travel manager should take into consideration when evaluating their travel payments strategy.

- Use relevant payment methods

- Understand regulations

- Follow payment-related trends

- Integrate payments with existing systems

In this three-part blog series, we will break down how each of these best practices can help you ensure your payments strategy is both efficient and accurate. Today, we’ll start with the importance of using relevant payment methods.

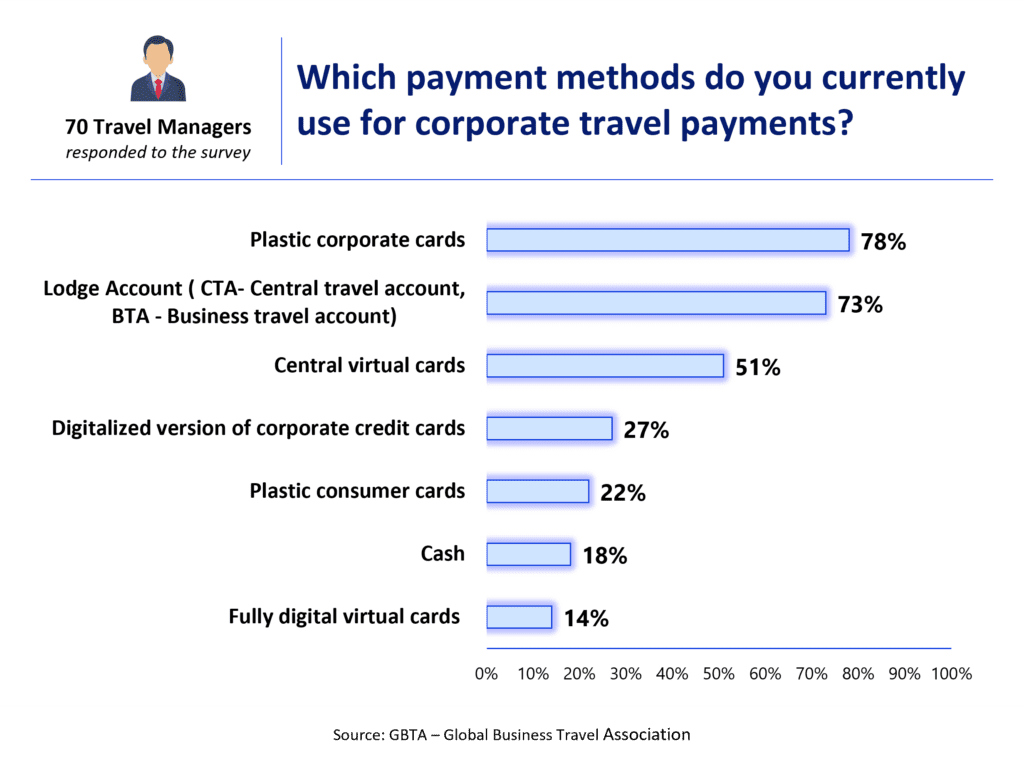

When we presented this topic to a group of 70 travel buyers during a GBTA event, we conducted a poll to understand the primary payment methods they used in their corporate travel programs. Based on this information, we’ve developed three key takeaways:

1. Remove cash and personal credit cards as approved payment methods

The first learning is that cash should not be an approved payment method for corporate travel. The survey revealed that a surprising 18% of travel managers still allow travelers to use cash. It’s simple; cash is expensive and inefficient. It involves too many manual processes for both corporates and travelers, and it should be removed from the approved payment methods or limited as much as possible.

The survey also uncovered that personal credit cards are allowed by 22% of travel programs. Personal credit cards should be avoided for two reasons. First, it is much more difficult for program managers to capture the travel spend. Since there is no integration between personal payment methods and an expense management platform, the process to track these payments is manual and inefficient. Second, when travelers aren’t using corporate cards to make purchases, the company is missing out on valuable financial rebates.

To avoid cash and personal credit card use, it is important that travel managers build this information into their travel policy and communicate payment guidelines to travelers frequently. Implementing a traveler-focused communication campaign around this message is a great way to facilitate change management and increase the use of recommended payment methods.

2. Encourage the use of electronic payment methods

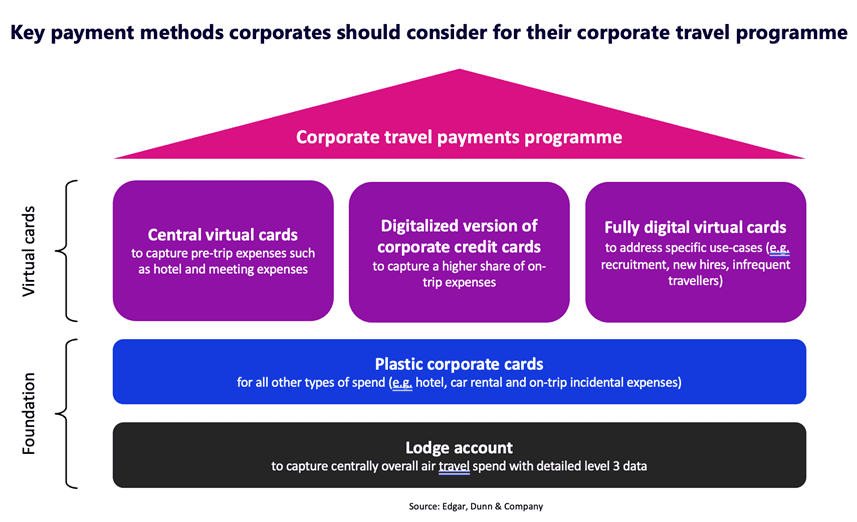

It is no surprise almost 80% of travel managers indicated they use corporate credit cards and almost 75% use a lodge or central account. From our perspective, lodge accounts and corporate credit cards are the two payment methods that form the foundation to capture travel expenses strategically:

- Lodge accounts are best used for air spend, centrally capturing expense data along with detailed travel data

- Corporate credit cards are ideal for all other types of spend (e.g. hotel, car rental, and on-trip incidental expenses)

3. Shift to virtual cards

While lodge accounts and corporate credit cards can provide travel managers with some great insights into traveler behavior and program expenses, virtual cards take it one step further. Virtual cards allow travel managers to capture additional travel spend, increase rebates and reduce costs, have more flexibility and control, and provide a better traveler experience. Here are the three main types of virtual cards travel managers can use today:

- Central virtual cards: These can be used centrally by travel managers or the finance department to capture pre-trip expenses, such as hotel or meeting expenses.

- Digitalized version of corporate credit cards: Corporate cards can be digitalized and added to mobile wallets such as Apple Pay and Google Pay. As corporate travelers increasingly use mobile wallets in their personal life, they will expect the same standard for corporate cards. By providing a better travel experience, travel managers will ensure employees use their corporate cards more often, and in turn, capture a higher share of on-trip expenses.

- Fully digital virtual cards: These are very convenient to address specific use cases for on-trip expenses where a physical, plastic corporate card is not possible or relevant. Examples of when to leverage fully digital virtual cards include travel for interviews during recruitment, for travelers who may not be eligible for a physical corporate card, or for new hires required to travel soon after starting their new job and have not yet received a physical corporate card. In these instances, a virtual card can be sent to the traveler and added to a mobile wallet such as Apple Pay and Google Pay. This provides flexibility for travel and expense managers and avoids manual processes and related costs.

Keep in mind, one of the biggest benefits of virtual cards is the additional control and flexibility for travel managers as they can restrict usage based on specific dates, amounts, or types of spend and merchant category codes (MCC). These features help significantly decrease risks and ensure compliance with travel policy.

While there are a variety of payment methods available to travelers today, it’s important to strategically select relevant methods for use within your program. By reducing friction points and creating a streamlined payments process, you can achieve significant savings, enhance the traveler experience and future-proof your travel program today.

Contact us to get started optimizing your corporate travel payments program.